A place in the sun

Owing to its complex relation with crude oil prices, the US dollar has managed to maintain its supremacy even during the Russia-Ukraine conflict

Last week, international crude oil prices had jumped to USD 139 a barrel at one point, the highest level for almost 14 years, while wholesale gas prices more than doubled. Nonetheless, during this volatile period, the US dollar has appreciated against all major currencies including Indian rupee. As India meets nearly 80 per cent of its oil demand through imports, Indian currency is likely to depreciate further vis-a-vis the US dollar if crude price increases further.

As the Ukraine war has pushed the international oil price to the north, the US dollar has also appreciated due to its complex relation with crude price which many analysts term as 'crude oil standard'!

Unlike the superpowers of the 18th and 19th centuries, namely the Ottomans and Britain, which had subjugated vast geographical regions under their direct control, the USA followed a different approach in the 20th century to retain its global supremacy. Unlike the previous empires, the USA usually preferred to work through local compradors that were on their side. The creation of the Japanese Liberal Democratic Party, after the Second World War, to retain their control on Japan, is a case in point. In addition to this political strategy, the other most important factor which has contributed immensely to maintaining USA's economic supremacy has been its ability to maintain the strength of its national currency — the US dollar. The question is how did they manage this supremacy of the dollar?

Gold standard to gold-equivalent standard

The fall of the gold standard in 1914, and subsequent chaos between two World Wars in the international financial system, resulted in a new system (the Bretton Woods System) in 1944. Under the new system, all members of the newly set up International Monetary Fund (IMF) were to fix the par value of their currency either in terms of gold or in terms of US dollar. The par value of the US dollar, in turn, was fixed at USD 35 per ounce of gold. For the purpose of such conversion, adequate gold reserves had to be maintained by the US government. Thus, the dollar — the national currency of the USA — was made equivalent to gold which, for centuries, had been used as the most acceptable currency across the globe. This unique status of the dollar had encouraged the US Fed to act as the de-facto Central Bank of the world. But Prof Robert Triffin cautioned the world about the inherent limitations of the Bretton Woods system, as early as 1960, resulting in its breakdown. According to him, it was necessary for the US to run a Balance of Payment (BoP) deficit to supply the world with the additional dollar reserves needed for increased international trade. As the volume of dollar reserves in other countries would grow without a simultaneous increase in US gold reserves, its ability to honour its commitment of converting dollars into gold would decrease, resulting in the breakdown of the system.

The decade-long Vietnam War during the 1960s had forced the US government to print dollars to meet its war expenditure at a disproportionately higher value compared to the official gold reserve the government had at its disposal. As the US government was not in a position to honour its commitment of paying USD 35 against every ounce of gold, on August 15, 1971, they allowed their currency to float. As expected, the value of the US dollar started to erode. The USA government tried to salvage the crisis by entering into an agreement (Smithsonian Agreement) with ten major members of the IMF. As part of this agreement, the dollar was devalued by raising the price of gold from USD 35 to USD 38 per ounce. In February 1973, it was further devalued to USD 41.22 per ounce and, finally, in mid-March 1973 when the major industrial countries had decided to float their currency, the Bretton Woods system was abandoned.

Gold equivalent standard to crude oil standard

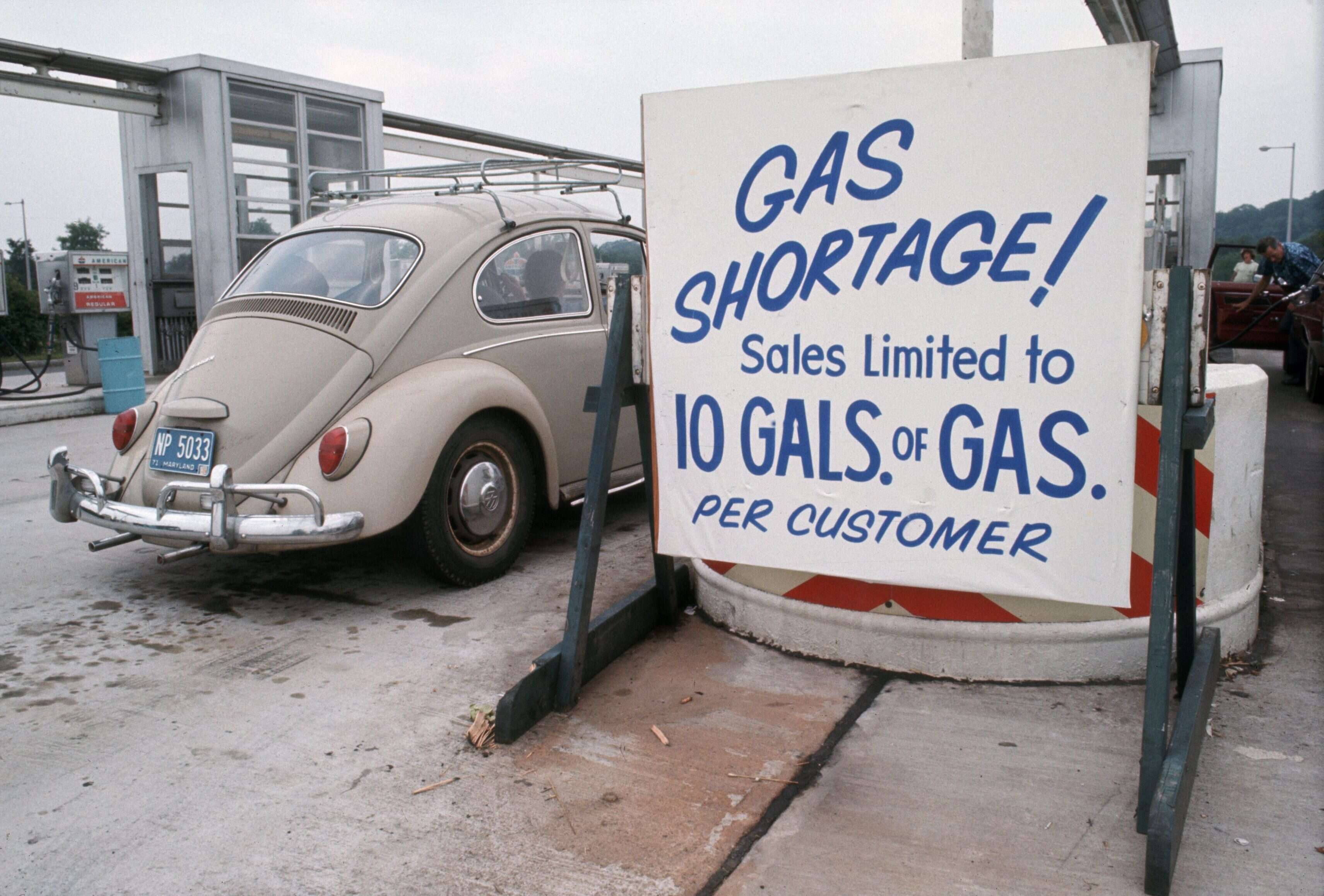

Economic historians claim that the oil shock of 1971 had aggravated the US BoP crisis that ultimately led to the breakdown of the global financial system in 1973. Interestingly, the USA had turned the Arab anger and associated the oil shock of the 1970s to their advantage. It is alleged that the Middle-east crisis was 'engineered' to establish a new 'standard' replacing the existing 'gold equivalent standard'. It may be recalled that on October 6, 1973, Egypt and Syria had attacked Israel. And on October 19, the US President declared an aid package of USD 2.2 billion to Israel, knowing fully well that it would force the Arabs into taking drastic actions. As anticipated, led by Saudi Arabia, Arab oil producers imposed a total embargo on oil shipments to the United States and, by January 1974, the price of Saudi crude leaped to a new record.

The USA formulated a strategy to (a) ensure that the Organisation of Petroleum Exporting Countries (OPEC) would funnel the billions of additional dollars earned on account of increased oil price back to US shores; and (b) establish a new 'oil standard' to strengthen the weakening dollar. To achieve the first objective, an agreement was entered into with the Saudi royal family. In return to the US promise of keeping the Saudi 'royal' family in power, the latter had agreed to (i) invest a large portion of their petro-dollar in the US government securities; (ii) allow the US government to utilize trillions of dollars, payable as interest on these investments, to hire US corporations to westernise Saudi Arabia; (iii) maintain the price of crude within limits acceptable to the corporations. And the second objective was achieved by earning a commitment from the Saudis to trade oil exclusively in the US dollar. Thus, the dollar sovereignty was re-established.

OPEC trades its oil in USD. Hence, when oil price increases, the demand for USD also increases and the dollar appreciates. Oil being a necessity, its demand does not fall immediately as its price rises.

USD felt threatened, for the first time, during the Earth Summit at Rio in 1992. At the Earth Summit, major initiatives were announced to combat global warming by reducing the use of fossil fuel. It may be recalled that the USA did not ratify the Kyoto Protocol on Climate Change (1997) which, among other things, tried to restrict the use of hydrocarbons. The failure of the Kyoto Protocol has jeopardised the European agenda to tame USD by restricting the use of oil, which is identified as a major source of greenhouse gas responsible for global warming.

The Russian invasion of Ukraine is a win-win situation for both Russia and the USA. War has pushed the oil and gas price to a record high. Russia, one of the major global suppliers of oil and gas, gains immensely. Higher oil prices are increasing demand for USD in the international market as importing countries, like India, will have to buy oil in the commodity market paying US dollar only.

Views expressed are personal